Adobe's Figma acquisition is a $20 billion bet to control the entire creative market

Adobe's Figma acquisition is a $20 billion bet to control the entire creative market

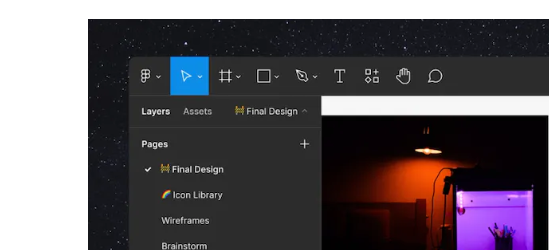

Over the past several years, Figma has made a name for itself as a forward-thinking and collaborative design platform and as a strong rival to giant Adobe in the creative app market. That rivalry ended on Thursday when Adobe announced it had struck a $20 billion deal to acquire Figma.

The acquisition will allow Adobe to add Figma's popular design tools to its widely used portfolio of creative apps. But the acquisition also means that Adobe will once again take a major competitor out of the market and bring it under its umbrella, for many designers who rely on the tool and still incorporate it into the company's Creative Cloud service. There are. Beware of important forums. , and they have a point: With Figma off the market, the list of companies capable of challenging Adobe's empire just got meaningfully smaller.

Adobe says the current plan is not to essentially change anything. Scott Belsky, Adobe's chief product officer and EVP of Creative Cloud, said in an interview with The Verge, "I think acquisitions are only good when they're done uniquely on a company-by-company basis and You'll never be able to access the playbook." Don't obey." Belsky says the Figma team will have "complete autonomy."

Figma's independence is a point they are underlining over and over again; A LinkedIn post by Belsky and a blog post by Figma CEO Dylan Field both noted that the plan is for Figma to continue operating autonomously. "The last thing anyone wants is to disrupt one of our roadmaps," Belsky said. This means there are no plans to bring Figma inside Creative Cloud and there is no change in the pricing of Figma according to Belsky.

advertisement

If anything, the earliest change may be in Adobe's favor. According to Belsky, Adobe is paying off its investment in Adobe XD, its competing design platform for things like apps and websites, and XD users may move to Figma in the future. "It was never because we didn't think about product design and development and this vertically integrated stack was a huge opportunity," he said. Right now, Adobe has a "small team" supporting XD for its existing customers. “Once [the acquisition] begins, we will figure out how to serve those customers, possibly with Figma,” he said.

Field knows they have to earn the trust of customers. "We have to establish that trust for Adobe and Figma, in what we do, what we're doing, and showing the community and around what's right is really consistent over time."

Adobe has a history of buying some of the biggest tools in the creative space, acquiring companies like Frame.io, a video production collaboration tool, and Behance, which lets people showcase their creative work. (Belsky previously joined Adobe through this acquisition.) The company has bought several companies—even Photoshop was an acquisition. This makes Figma even more relevant to designers; One of the few notable challengers to Adobe has been removed, which means Adobe will continue to consolidate creative app power in one place.

The purchase is not necessarily an antitrust concern, but it could still come under scrutiny by regulators. "It certainly looks like Adobe is in a dominant market position, and this acquisition will increase that dominance," Matt Kent, a competition policy advocate for consumer advocacy organization Public Citizen, said in an interview. But just because Adobe is bigger, doesn't mean the merger violates the law, he said.

There were mixed views on the acquisition of competing developers. Affinity, which offers its suite of creative software, believes the acquisition could underpin innovation in the creative app space. "Any developers in that community being acquired by Adobe will likely be suppressed, as their intentions become increasingly aware of what Adobe is good for. Ultimately this may reduce the options available only to creatives. Affinity Ashley Hesson, managing director of developer Serif, said in an emailed statement.

Alludo, which makes the chorale a suite of instruments, took on a more positive tone. Prashant Ketkar, CTO and CPO, Alludo, said, “While we have no specific comment on Adobe's news, this move is certainly validating what we have been believing for many years – the world of design. In. Collaboration tools are important." , said in an emailed statement. "We hope this movement will only gain momentum."

Adobe is making this acquisition at a time when regulatory bodies are getting more serious about cracking down on large tech mergers. For example, the Federal Trade Commission (FTC) sued in July to block its acquisition of Meta, the company behind VR fitness app Supernatural, and Nvidia's now-scraped arm in November. FTC spokeswoman Betsy Lordon said the FTC does not comment on the proposed transaction, and Justice Department spokeswoman Arlene Morales declined to comment.

The Figma acquisition is expected to close sometime in 2023, and will undergo regulatory scrutiny before doing so. If that happens, both companies will have a lot to prove. In January 2021, Field tweeted that "our goal is to be Figma, not Adobe," and I asked him how he felt about the tweet now that he would soon be a part of Adobe. "I still stick to that tweet, and not because I have any objections about Adobe," he said. "We have been very focused on Figma's autonomy throughout all of our negotiations regarding this acquisition."

No comments